ATTENTION: Income Investors

DIVIDEND ACCELERATORS WEEKLY:

All-Weather Dividend Leaders: Analysis of 4 Industry Giants

Stock Selection #1

Cisco Systems (CSCO) emerges as our leading pick for dividend-focused investors seeking both stability and growth potential. With its dominant position in network security and cloud technologies, CSCO continues to adapt and thrive in the evolving tech landscape. The company's impressive $21.8B cash position, combined with consistent dividend growth and strategic acquisitions, positions it well for future expansion.

Before continuing with our analysis below, I wanted to share something timely. One of our trusted research partners just sent over an exclusive presentation that crossed my desk this morning. Their latest deep dive into a developing market opportunity definitely caught my attention and I think you'll find it valuable.

⬇️ Continue reading below for our complete CSCO analysis ⬇️

[Urgent] Starlink Set For The Largest IPO In History?

[Urgent] Starlink Set For The Largest IPO In History?

He turned PayPal from a tiny, off-the-radar startup… to a massive $64 billion giant. Then, he did it again with Tesla… which is up more than 19,500% since 2010. For perspective, that turns $100 invested into almost $20,000! And now, Elon could be set to do it for the third and final time… with what might be his biggest breakthrough yet. And for the first time ever, you have the rare chance to profit BEFORE the upcoming IPO. Click here now for the urgent details on this hidden play.

|

Cisco Systems (CSCO)

Price Target: $62.60

Change 1W: -0.17% | Change 1M: +2.65%

Market Cap: $233.07B

Last Dividend Amount: $0.40

Expected Ex-Dividend Date: January 3, 2025

Expected Payment Date: January 22, 2025

Expected Dividend & Yield: 2.73%

Earnings Date: January 28-February 3, 2025

POSITIVE FACTORS

- • Strong cash position of $21.8B provides flexibility for strategic investments and dividend growth

- • Network security segment showing robust growth amid increasing cyber threats

- • Consistent dividend growth with 2.71% 5-year CAGR

- • Healthy operating margins at 19.4% demonstrate pricing power

- • Recent acquisitions strengthening cloud security portfolio

- • 27.3% gain over past 6 months indicates positive momentum

NEGATIVE FACTORS

- • P/E ratio of 25.12 trades at premium to historical average

- • Increasing competition in core networking business

- • Recent revenue growth of 2.5% suggests mature market dynamics

- • Supply chain constraints may impact near-term margins

- • Technological shifts to cloud computing could pressure hardware sales

- • Higher interest rates may affect enterprise IT spending

Final Thoughts on CSCO

CSCO's strong market position, healthy financials, and strategic growth initiatives make it a compelling consideration for your portfolio. While no investment is without risk, the combination of steady dividend growth and potential capital appreciation aligns well with a balanced investment approach.

You can proceed to our next stock pick, or take a moment to review another timely opportunity that one of our research partners shared with us. Their analysis of an emerging trend has particularly interesting implications for tech sector investors.

Click below to view a special presentation from our trusted research partner about an emerging market opportunity we think you'll find valuable.

⬇️ ⬇️ ⬇️

looking for opportunities?

YOU NEED TO CLICK BELOW...

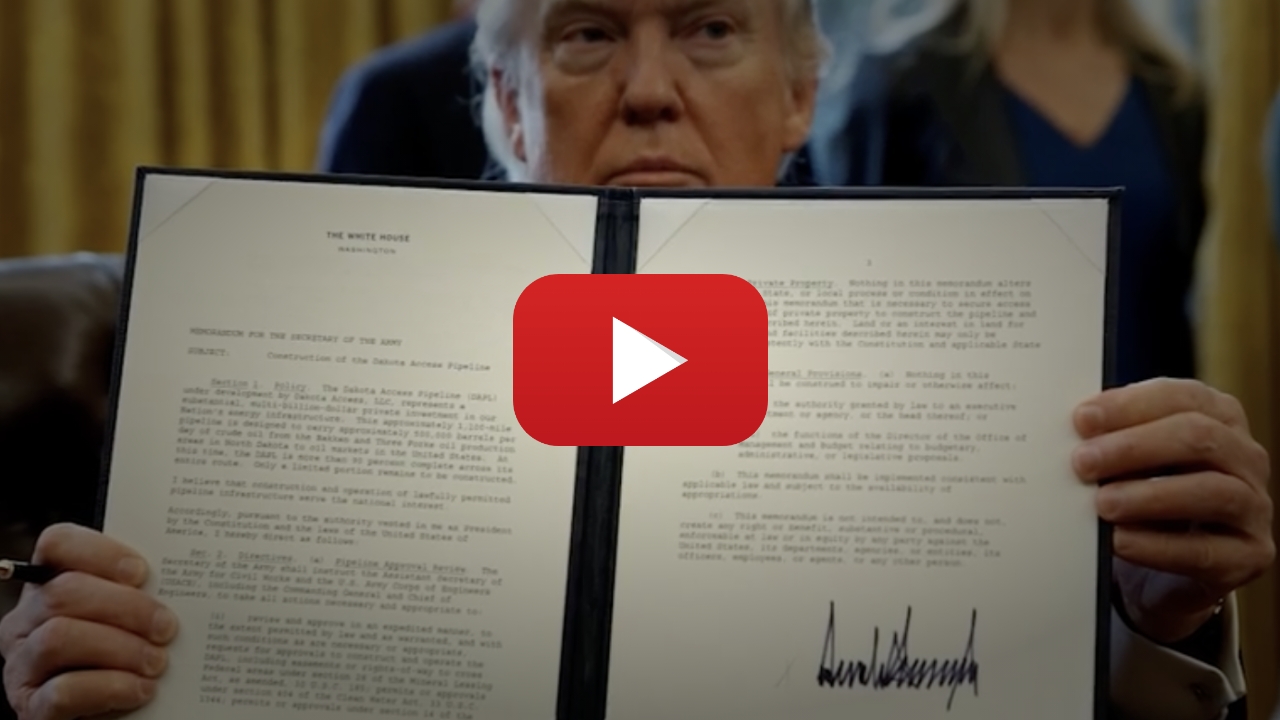

This secret document contains stunning details about Donald Trump’s very first order of business… the minute he steps back into the White House.

Because if what’s in this leaked document is even half true (and trust me, it comes from a very, very credible source)...

Trump’s first Executive Order would easily be the boldest, most mind-blowing and daring American initiative ANY U.S. President has launched in over 80 years.

It could set off a huge dose of “Trump Market Euphoria”... igniting a buying frenzy in very specific stocks... unlike anything we’ve seen so far.

Click here and see for yourself.

Disclaimer

DividendWealthBuilders.com, a brand under Market Insiders Media dba, operates under the parent company Sandpiper Marketing Group, LLC. Please be advised that DividendWealthBuilders.com is not registered as an investment adviser or broker-dealer with the United States Securities and Exchange Commission or any state regulatory agency. We rely on the "publisher's exclusion" from the definition of investment adviser as set forth in Section 202(a)(11) of the Investment Advisers Act of 1940, as amended, as well as corresponding state securities laws. Consequently, DividendWealthBuilders.com does not offer or provide personalized investment advice.

The information we provide is based on our opinions, statistical and financial data, and independent research of public information. Our materials are intended for informational purposes only, and no mention of a specific security in any of our content constitutes a recommendation to buy, sell, or hold that or any other security. Any information deemed to be investment opinion is impersonal and not tailored to the investment needs of any individual.

Please be aware that DividendWealthBuilders.com does not promise, guarantee, or imply that any information provided through our websites, newsletters, reports, or printed material will result in profit or loss. We strongly encourage you to seek personal advice from your professional investment, tax, or legal advisors and to conduct your own due diligence and independent investigations before acting on any information we publish or making any investment decision. Only you and your professional advisors can determine the level of risk appropriate for you. Penny stocks, in particular, are inherently speculative investments, and you should be prepared to lose your entire investment.

Employees, owners, and/or writers of DividendWealthBuilders.com may own positions in the equities, options, and/or securities mentioned in our content. However, no associated employees will intentionally engage in any transaction that directly or indirectly competes with the interests of our subscribers. DividendWealthBuilders.com may be compensated for publishing information about companies referred to in our reports, newsletters, and websites, and we provide full disclosure of such compensation.

Furthermore, please note that any content marked as "Sponsor" may be paid for and is not endorsed or warranted by our staff or company. The content in our emails is for educational or entertainment use and is not a substitute for professional advice or an offer to buy or sell any securities. Neither the publisher nor the editors are registered investment advisors (RIA’s) and do not provide personalized counseling. Be sure to conduct your own careful research and consult with your advisors before taking any action based on our content. By opening our emails or clicking any links contained therein, you are reconfirming your opt-in status, which is part of your free subscription.